MOL to Become World's 1st Shipping Company to Issue Blue Bonds

TOKYO-Mitsui O.S.K. Lines, Ltd. has announced that it has decided to issue "blue bonds" through a public offering in Japan's domestic market in January 2024.

The bonds are the world's first blue bonds in the shipping industry, which refer to the guidance (Note 1) provided by the International Capital Markets Association (ICMA) and other organizations. The Blue Bond Framework developed for the issuance of the bonds will ensure that all uses of the bonds' proceeds will contribute to a sustainable blue economy, and the bonds received the highest rating of "Blue1(F)" (Note 2) from the Japan Credit Rating Agency, Ltd. (JCR) based on its expectation that they will have a positive environmental impact.

A blue bond is a type of green bond issued to finance green projects that aim to solve environmental problems and is issued with the use of proceeds limited to projects related to the prevention of marine pollution, sustainable marine resources, and so on.

MOL has positioned its environmental strategy as a key element of its group management plan "BLUE ACTION 2035," established this year, and set "marine and global environmental conservation" as one of its sustainability issues (materiality). The company set a total of 650 billion yen to be invested in resolving environmental issues over the three-year period from FY2023 to FY2025. It will raise funds through blue bonds to finance these initiatives.

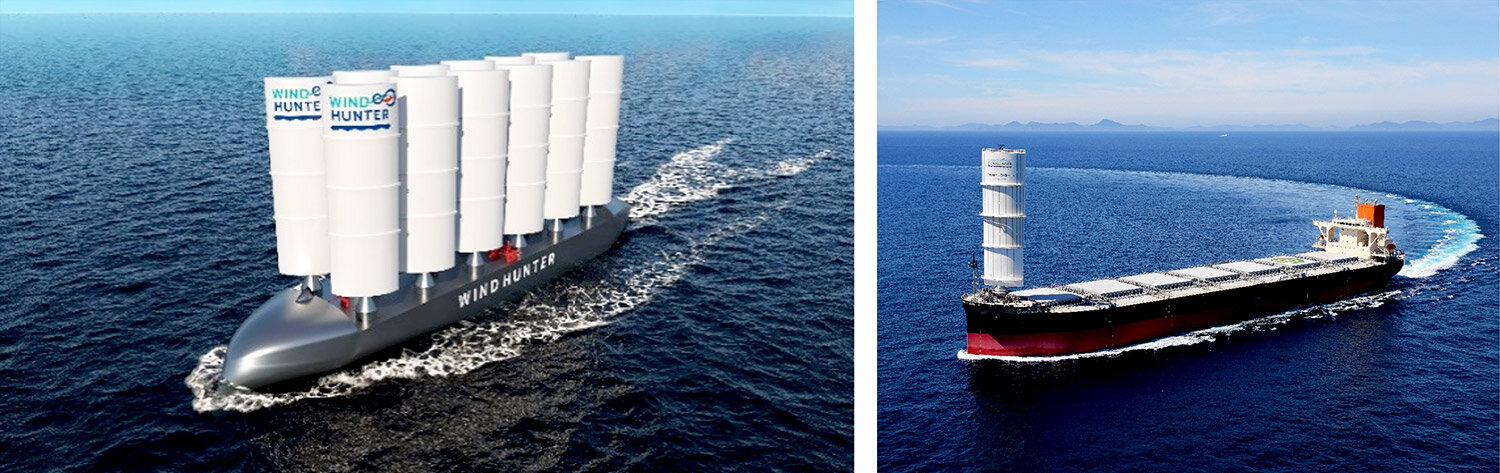

(Examples of potential uses of the bonds' proceeds: left, Wind Hunter, the ultimate zero emission ship;

right, a vessel equipped with the Wind Challenger sail for the new era)

[Outline of Blue Bonds]

| Serial number of bonds | 26th series unsecured corporate bonds |

| Maturity | 5 years |

| Issue amount | 10 billion yen (planned) |

| Issue date | Scheduled for January 2024 |

| Lead managers | Daiwa Securities Co., Ltd., Nomura Securities Co., Ltd., Mizuho Securities, Co., Ltd., Shinkin Securities Co., Ltd. |

| Blue bond structuring agent | Daiwa Securities Co., Ltd. (Note 3) |

(Note 1)

International Practitioner Guidance on Blue Bonds developed by the International Capital Market Association (ICMA), International Finance Corporation (IFC), United Nations Environment Programme - Finance Initiative (UNEP FI), UN Global Compact, and Asian Development Bank (ADB).

(Note 2)

MOL asked JCR to evaluate the framework to ensure its eligibility and transparency and to improve its appeal to investors. On December 15, 2023, it acquired a "Blue 1 (F)" rating, the highest rating in the "JCR Blue Bond Framework Evaluation."

(Note 3)

Parties providing support for the issuance of blue bonds by advising on the development of the Blue Bond Framework and the acquisition of third-party valuations.

[Blue Bond Framework]

https://www.mol.co.jp/en/sustainability/management/finance/pdf/blue_bond_framework.pdf

[JCR Blue Bond Framework evaluation]

JCR Blue Bond Framework evaluation